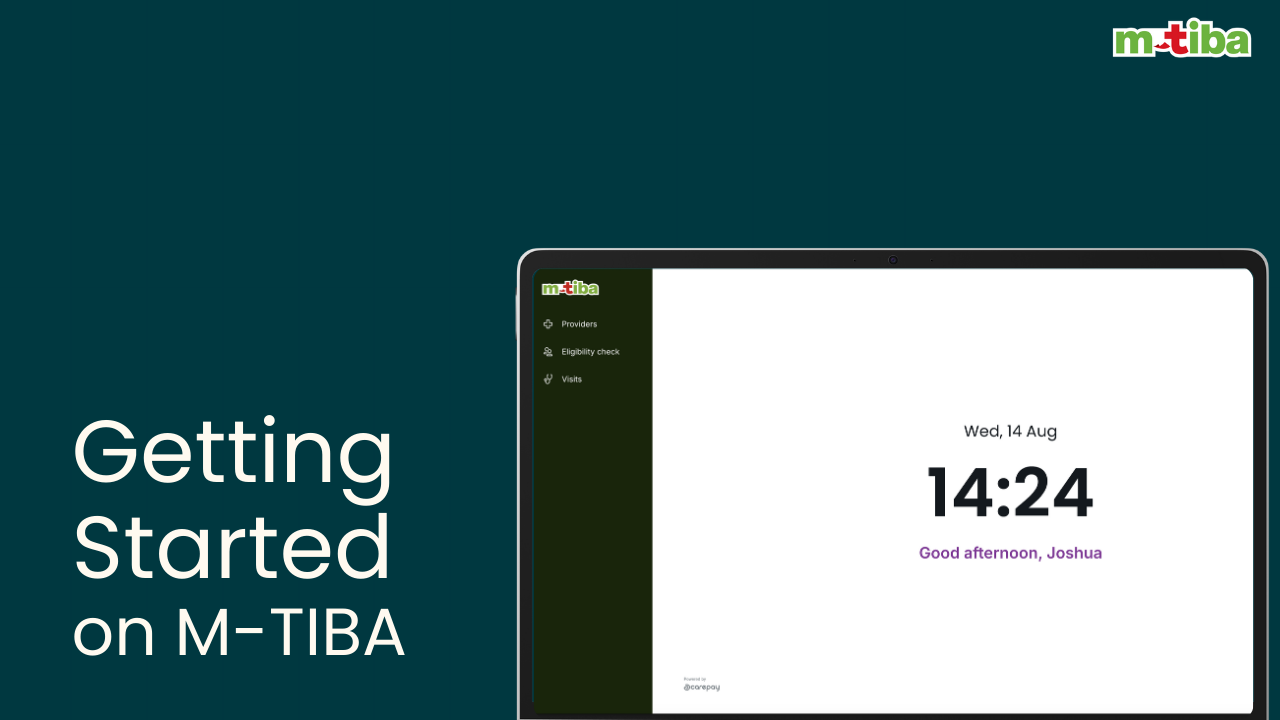

Get started with the basics on M-TIBA

From simply logging in to forgetting your password and more.

Step by Step Guide

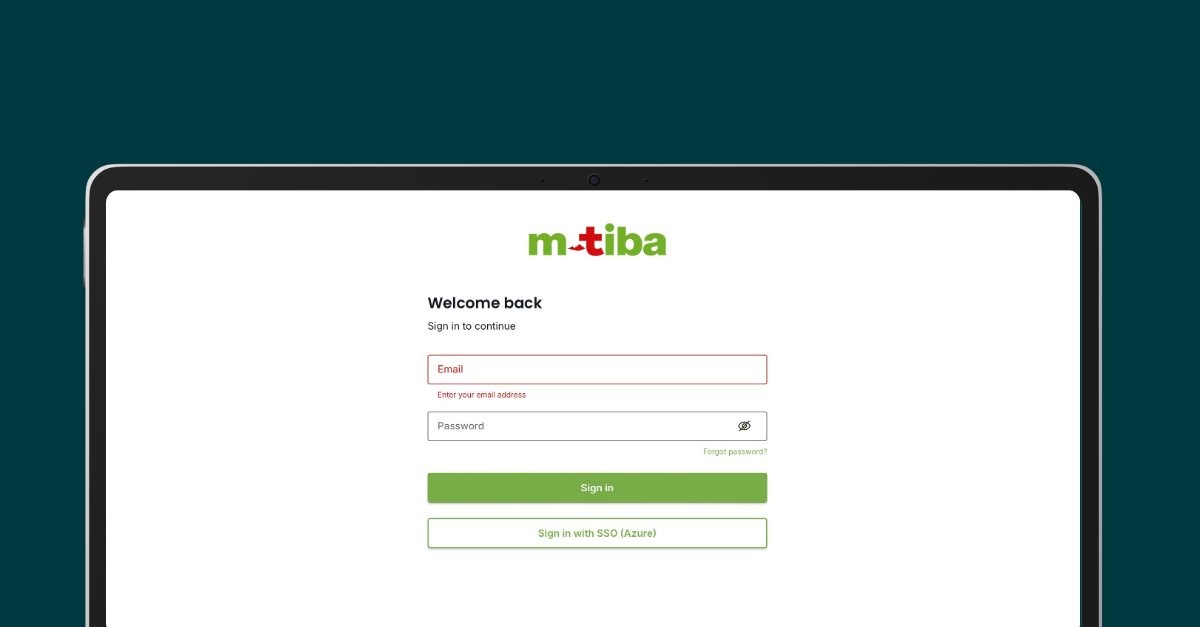

Log In

- Input https://portal.mtiba.com/ URL on your browser

- Input your provider/work email

- Input your password

- Click sign in

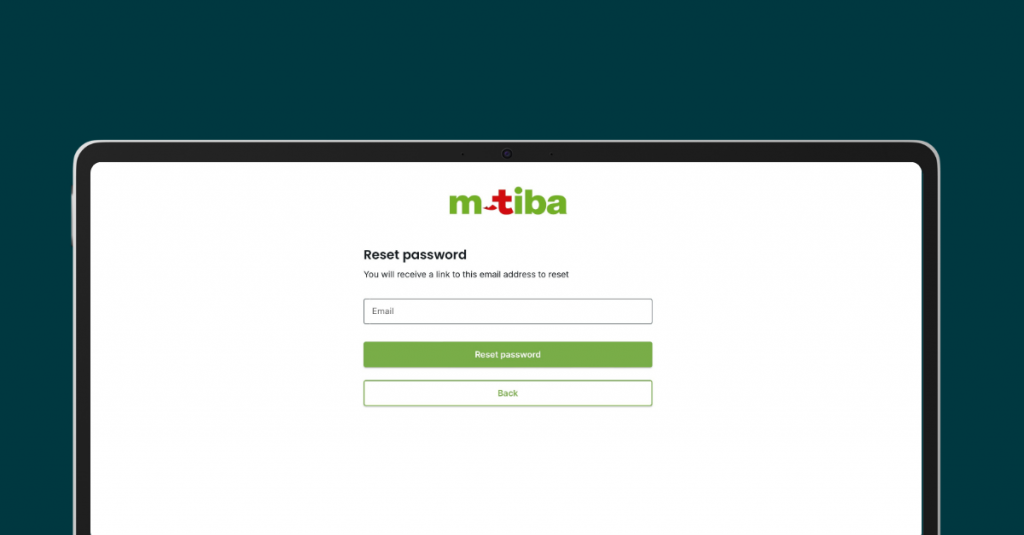

Forgot Password

- Click on forgot password

- Input your work email

- Password reset instruction will be shared to your email

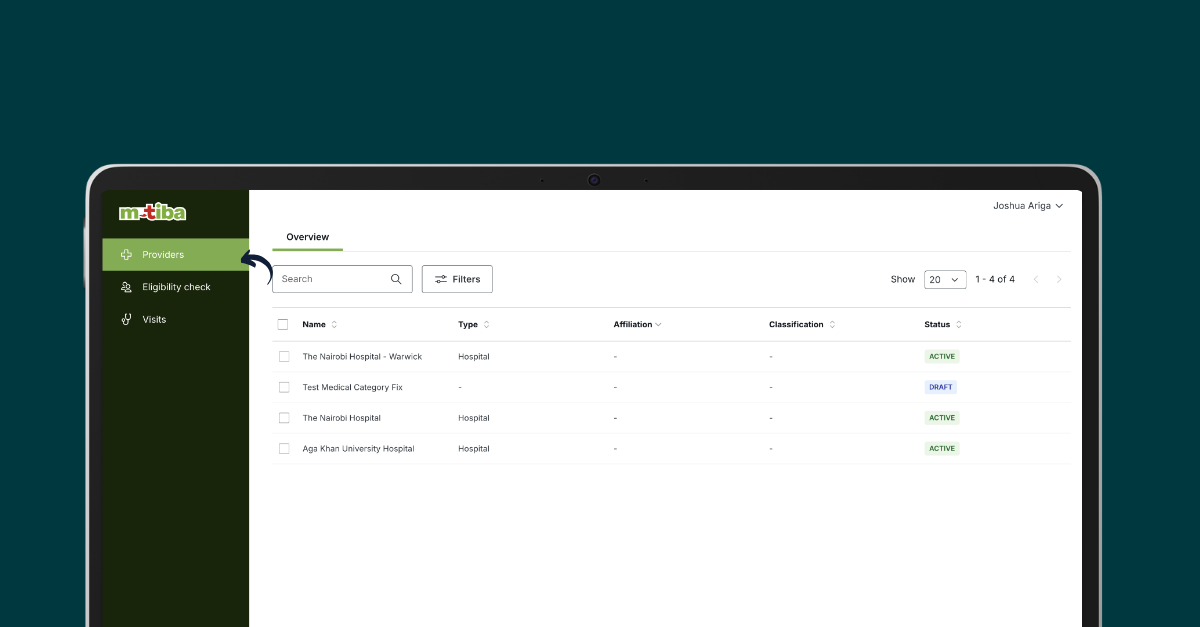

Selecting your provider outlet

- On the left tab, click the providers tab

- Select your clinic or branch

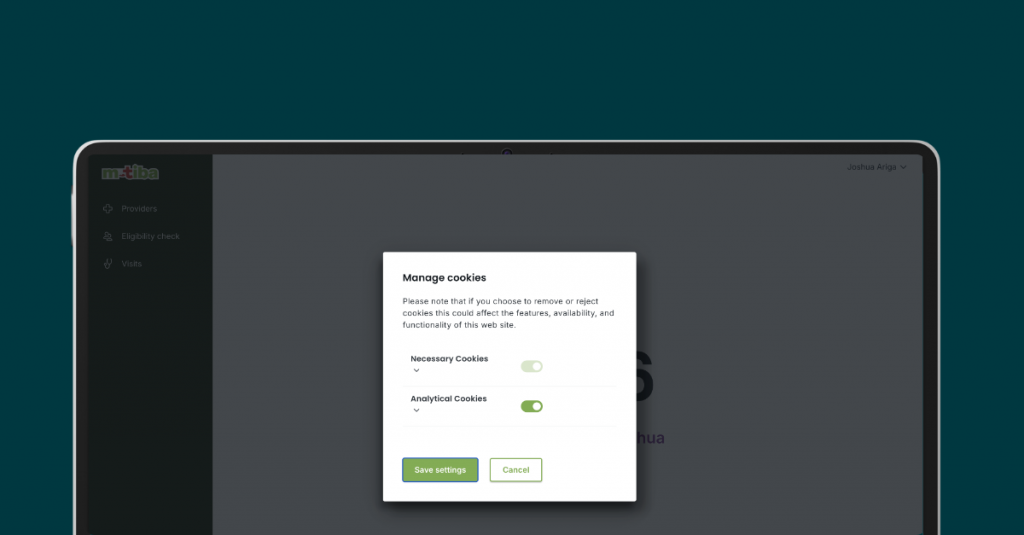

Cookies

We use cookies, web beacons and other technologies to improve and customize your experience while using the Platform. We recommend turning this on for easier trouble shooting and support.

Frequently Asked Questions

M-TIBA Terms and Definitions

Term | Definition | Notes |

|---|---|---|

| A | ||

Acceptance environment | A test environment that is used to perform (user acceptance) testing on the CarePay system. |

|

Accident | An unforeseen, unexpected and unintended event resulting in bodily injury. |

|

Account | CarePay system term. Beneficiaries are linked to a program through an account:

| |

| The principal is an account holder by default. Adult dependents can be designated as account holder as well. Note that account in this case refers to a user account, not to be confused with an account on a program (policy). | |

Accreditation | Proof that a program or provider meets certain standards. An independent party decides this through an official review. |

|

Age limit | The age below or above which a payer will not accept enrolment or renewal. |

|

Agency |

An organization that acts as a delegate of a payer. A payer can delegate one or more tasks to one or more agencies. These tasks include:

| Also see Standard Actors. |

Agent |

| Also see Standard Actors. |

Agent App | Mobile app used by agents to register beneficiaries on the CarePay platform and/or enroll them in a program. |

|

Agent code | Unique agent identifier used by agents to claim commissions and/or bonuses. |

|

Annual limit | The maximum amount that is covered under a specific program in any given year. | Also see CarePay Master List of Terms and Definitions#Limit. Depending on program settings, various annual limits may apply, for example per beneficiary and/or per account. |

| ||

B | ||

Beneficiary |

| Obsolete. See CarePay Master List of Terms and Definitions#Participant. |

Benefit | Any service (e.g. consultation, laboratory test, surgical procedure) or supply (e.g. medicine) covered under a program. |

|

Benefit limit | The maximum amount that is covered under a specific program for a specific covered benefit. | Also see CarePay Master List of Terms and Definitions#Limit. Depending on program settings, various annual limits may apply, for example per beneficiary and/or per account. |

Billing station | Sub-group of a provider organization (for example some specific department), uses its own invoices (separate from other billing stations) to help identify different forms of care in a treatment record. | Providers are completely free to define billing stations as they want. |

Bonus | A monetary reward that is awarded to eligible members. | Eligibility is determined by detailed bonus rules. A bonus could be related to making regular savings, referring new members, et cetera. |

| ||

C | ||

CALC | Network for financial transactions (commonly referred to as Automated Clearing House or ACH) developed and used by CarePay. | CALC can be used via two portals:

|

Capitation | A method of compensation per patient (and per period). | The number of patients used to determine capitation amount is typically defined as the number of enrollees who have set the provider in question as their preferred provider. |

Case management | The process of ensuring that health insurance benefits are being properly and fully utilized and that non-covered services are avoided when possible. Case management is the responsibility of the payer, but may be delegated to an Agency. |

|

Case manager |

An individual who executes case management, typically by performing pre-authorizations for treatments.

| Also see Standard Actors. |

Cash advance | A loan product provided to providers following an agreement with CarePay and Medical Credit Fund. |

|

CBP | CarePay Business Processes |

|

CBR | CarePay Business Requirements |

|

CDS | CarePay Database Setup |

|

Chronic condition | A condition that is permanent, recurring or long lasting. |

|

Claim |

| A claim can have one of the following statuses in the CarePay system:

Also see CBP – CLM: Manage Claims. |

Claims management | The process of reviewing and approving submitted claims in line with treatment and payment guidelines. |

|

Claims manager |

Person responsible for reviewing submitted claims and making judgement on approval and rejection in line with treatment and payment guidelines.

| Also see Standard Actors. |

Commission | Transaction of money from a payer to an agency / agent to pay for the execution of tasks by that agency / agent on behalf of the payer. |

|

Compensation | Transaction of money from a payer to a provider to pay for care provided under a specific program. | Types of Compensation include CarePay Master List of Terms and Definitions#Capitation and Fee for service. |

Corporate program | A program, in which only employees of some specific employer can enroll as principal. The employer in question may or may not:

|

|

| ||

D | ||

Data transaction | A transaction in the CarePay system, in which no (mobile) money is involved. |

|

Date of service | The date on which a treatment was provided. |

|

Day case | A treatment without overnight stay. |

|

Dependent |

Any member on an account who is not the Principal.

| Depending on program settings, different types of dependents may be defined. Spouse and child are the most common types of dependents. |

| ||

E | ||

Effective cover date | The date on which a health insurance cover comes into effect. |

|

Eligibility | Terms that decide who can get coverage. These terms may include health conditions, age, employment status, et cetera. |

|

Employer |

| Also see Standard Actors. |

Enrollee |

An individual who is enrolled in a health program.

|

|

Enrolment | The process of enrolling beneficiaries in health programs. This involves capturing and storing account details related to a specific health program. A beneficiary must be registered before he/she can enroll in health programs. | Also see CBP – REG: Manage Registrations. |

Exclusion | Specific medical condition or circumstance that is not covered under a program. |

|

| ||

F | ||

Facility | A term commonly used to designate any healthcare provider, whether a doctor, a hospital or clinic. |

|

Fee for service | A method of compensation based on the costs of services provided. |

|

Financial transaction | A transaction in the M-TIBA platform that undergoes financial implications on the system (e.g. MTIBA fees, Safaricom fees). |

|

| ||

G | ||

Grace period | A period after the premium payment due date, during which insurance coverage remains in force and the policyholder may make a payment without penalty. The user might be able to access or not access the benefit depending on the program rules. |

|

| ||

H | ||

Health insurance | A contract that requires a health insurer to pay some or all of a member’s health care costs in exchange for a premium. |

|

Healthcare organization | Health Provider with one or more healthcare facilities. |

|

Hospitalization | Services related to staying at a hospital for either scheduled procedures, accidents or medical emergencies. Hospitalization services typically do not include hospital stays for giving birth to a child. |

|

| ||

I | ||

Inpatient | A term used to describe a person admitted to a hospital for at least 24 hours. It may also be used to describe the care rendered in a hospital when the duration of the stay is at least 24 hours. |

|

Inpatient insurance | Insurance intended to provide coverage in case of hospitalization, including benefits for room and board and miscellaneous expenses, within certain limitations. |

|

Inpatient service | Services provided when a member is registered as a bed patient and is treated as such in a health care facility such as a hospital (see Hospitalization). |

|

In-progress treatment | A treatment with the status in-progress refers to a treatment where the provider has started billing but not yet submitted. |

|

Insured person | The person who a contract holder (an employer, individual or Insurer) has agreed to provide coverage for, often referred to as a member/subscriber. |

|

Insurer | The insurance company that offers health insurance plans. |

|

Invoice | Group of invoice items, part of a treatment record. | Every treatment record contains at least one invoice. Invoices can be used (optionally) by a provider for internal accounting purposes |

Invoice item | Predefined element of care, can be selected by a provider from the Product List to capture details of care provided, forms the basis for subsequent claims. |

|

| ||

J | ||

J |

|

|

| ||

K | ||

K |

|

|

| ||

L | ||

Lapse | The termination of insurance coverage due to lack of payment after a specific period of time. |

|

Length of stay | The total number of days that a patient stays in a facility such as a hospital. |

|

Life | Refers to a single person in the system who has an active benefit(program) attached to them with a status enabled. |

|

Limit | Any maximum that a health insurance plan imposes on specific benefits. |

|

| ||

M | ||

Maternity (inpatient) | Typically, inpatient maternity services include hospitalization and physician fees associated with the birth of a child. |

|

Maternity (outpatient) | Typically, outpatient maternity services include antenatal and postnatal services. |

|

Member | An individual who is registered on the CarePay platform. | Also see Standard Actors. |

Member App | Mobile app used by beneficiaries to self-register on the CarePay platform and/or enroll in a health program. |

|

M-PESA | Mobile payment service provided by Safaricom. |

|

M-TIBA | Mobile payment service provided by Safaricom where money is earmarked for healthcare payment only. |

|

| ||

N | ||

Next of kin | A person, usually a spouse who can claim on behalf of the member in case of death/incapacitation. This is mostly applicable for Afya Kamili product. |

|

| ||

O | ||

Outpatient |

|

|

Outpatient procedure | Some procedures can be done in a hospital, surgery centre or doctor’s office. The person goes home after the procedure. There is no overnight stay. This is also called Day case. |

|

Outpatient service | Treatment that is provided to a patient who can return home after care without an overnight stay in a hospital or other inpatient facility. |

|

| ||

P | ||

Partial disability | A condition in which, as the result of an illness or injury, a group health insurance member cannot perform all the duties of his or her occupation but can perform some. |

|

Participant | An individual who can register on the CarePay platform and enroll in one or more programs. | This term replaces beneficiary, which was used before and still appears in many places. |

Partner user | A user who administers a benefit on a payer’s behalf. |

|

Patient | Person seeking treatment at a provider, can be either a principal member or a dependent. |

|

Payer |

| Also see Standard Actors. |

PIN | Personal Identification Number |

|

Policy (contract) | This is a legal agreement between a customer (an individual or group) and an insurance plan. It lists all details of the plan’s coverage. |

|

Pre-auth treatment | A treatment with the status ‘pre-auth’ has been submitted to the case manager to authorise treatment. |

|

Pre-authorization | The process by which members or provider notifies the health plan administrator of treatment plans, such as a hospital admission or a complex diagnostic test. |

|

Pre-existing condition | A condition, disability or illness that you have been treated for before applying for new health coverage. A health problem that existed or was treated before the effective date of your health insurance coverage. |

|

Preferred provider | A provider who has a contract with your health insurer and who a member selects to use from a list. |

|

Premium | Amount to be paid for a specific account on a specific program. | This amount is typically dependent on account composition (number and type of beneficiaries) and the cover/insurance package. Premium payments may be due monthly, quarterly, or annually. |

Price | Costs associated with a product. |

|

Price List | List of the specific products offered by a provider and the associated prices under a specific program. | For every program, there is one Product List, defined by the payer. There could be many different Price Lists, one for every provider. Different Price Lists may contain different products (usually, providers don’t offer all products on the Product List) and may also contain different prices (unlike the products in the Product List, which are defined by the payer, the associated prices in the Price List are negotiated between payer and provider). |

Principal |

The main beneficiary on an account.

| Also see Standard Actors. |

Product | Predefined element of care (drug, procedure, lab test, et cetera). |

|

Product List |

| |

Production environment | The live environment that is used to run the CarePay system. |

|

Program | System of benefits, with predefined rules for eligibility and coverage. Eligible beneficiaries must enroll in a program before they can enjoy its benefits. The following types of programs exist:

| Also referred to as Health Program. Other common terms include (Health) Plan and (Health) Scheme. |

Provider |

A licensed health care organization that delivers health care services.

| Also see Standard Actors. |

Provider network | A group of providers that have signed a joint agreement on the services they offer under a specific program, and the costs they charge for those services. | Typically, the network provides services at a special rate. In some programs, coverage is more extensive when patients seek treatment at a provider in the network. |

| ||

Q | ||

Q |

|

|

| ||

R |

| |

Registration | The process of registering beneficiaries on the CarePay platform. This involves capturing and storing personal details, irrespective of health programs. |

|

Reimbursement | Restitution by a payer of costs that are covered under a particular program, but were paid by an enrollee in that program. | Not to be confused with compensation, which is paid by a payer to a provider. |

Remittance | Transaction of money into a savings account by someone who is not an account holder. | Not to be confused with saving. |

Remitter | A person who sends a remittance. |

|

Renewal | Continuation of an account beyond the original duration of the contract. | Accounts are typically created and renewed for a period of one year. |

Renewal date | The date on which a member’s health insurance plan benefit year renews. |

|

Re-opened treatment | Status of a treatment that has been submitted by a provider but the claim manager re opens it for the provider to make adjustments to the claim. |

|

Risk | The chance or likelihood of loss. |

|

| ||

S | ||

Saving | Transaction of money into a savings account by an account holder. | Not to be confused with remittance. |

Sponsor | This is a group that sets up and manages a health plan or group insurance plan. It can be an employer, labour union, government agency or non-profit group. |

|

Spouse | Partner (in a marriage) of the principal. |

|

Submitted claim | A status of a claim that the healthcare provider has submitted to the claim manager and the healthcare provider has finished billing. |

|

Submitted treatment | A treatment with status ‘submitted’ has been submitted to the claim manager to work on the claims contained in it. |

|

| ||

T | ||

T&C | Terms and Conditions | May refer to CarePay T&C related to personal data or program T&C related to program specific data. Beneficiaries must accept the CarePay T&C to register on the CarePay platform, and accept program T&C to enroll in a program. |

Tariffs | Signed off agreed service specific charges by CarePay with contracted Health providers. |

|

Temporary partial disability | This term is used to describe the condition of a person who due to injury is unable to work at full capacity but who is able to work at reduced efficiency and is expected to fully recover. |

|

Temporary total disability | This term describes the condition of a person who due to injury is unable to work, but who is expected to fully recover. |

|

Testing environment | Environment used by the development team when building the system. |

|

Till | Service from Safaricom that allows merchants, including providers, to accept payments by M-PESA for services offered. |

|

Training environment | Environment used for demos / training. |

|

Transaction code | Unique identifier associated with every transaction at a provider. |

|

Treatment |

|

|

| ||

U | ||

Underwriter | Company that performs underwriting and takes the risk on the submitted claims. |

|

Underwriting | The process by which an insurer determines whether it will accept an application for insurance based upon risks and projections, and through which a determination on monthly premium is made. |

|

USSD | Unstructured Supplementary Service Data | Users can access the CarePay platform via (amongst others) USSD. |

Utilization | This term refers to how frequently a group uses the benefits associated with a health insurance plan or healthcare program. |

|

| ||

V | ||

Voucher | A text message or printout that entitles the holder to a discount or free access to health care. |

|

| ||

Waiting period | A period after the cover start date during which an enrollee is not allowed to access services on that cover. |

|

Withdrawal | A request from a provider on CALC to transfer money to their M-PESA account or bank account as payment for services offered. |

|

| ||

X | ||

X |

|

|

| ||

Y | ||

Y |

|

|

| ||

Z | ||

Z |

| |

Log in to older M-TIBA platform

Start a visit

If member has been migrated to the new portal, you will get a link that redirects you to the new platform

Log into the new platform

Create your account

Start billing

Incase of an inquiry:

Contact customer support on 0800721253

The M-TIBA platform handles administrative tasks and operations related to healthcare plans for insurance companies. This includes processing claims and making payments to healthcare providers on their behalf.